Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

The Hidden Costs of ‘Waiting Until Later’ on Your Health, Wealth, and Mindset

Waiting until 'later' isn’t just a delay—it’s a costly decision your future self will wish you hadn’t made.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Debunking Investing Myths

Every investor has heard at least one “rule of thumb” that sounds too simple—or too ominous—to be true. Some of these “tried and tested” maxims come from decades of market folklore; others are simply repeated so often they start to feel like fact. In this post, we’ll debunk six common investing myths using historical data and a long-term perspective.

Rethinking Education for Fulfillment and Financial Well-Being

If we want to set the next generation up for success, we need to go beyond achievement and income. We need to help them invest in their strengths, align their financial choices with their values, and build lives of purpose, impact, and fulfillment.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

The Generosity Gap: Balancing Support and Independence in Families

When approached thoughtfully, wealth can be a catalyst for growth and opportunity rather than a source of conflict. Families that prioritize clear communication, shared values, and personal accountability are better positioned to navigate the challenges of the generosity gap.

Maximizing Your Cleveland Clinic Retirement Benefits: What You Need to Know

Working at Cleveland Clinic comes with a variety of financial perks—chief among them are the retirement plans that can help you build long-term wealth. Understanding how to leverage each plan fully can feel overwhelming. Below, we break down the key features of the 401(a), 403(b), and 457(b) plans, plus the Equity Accumulation (EA) program. We’ll also explain how to implement a “mega backdoor Roth” strategy within the 403(b), so you can take your retirement savings to the next level.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Missing the Best Days in the Market: The Up and Downs of Staying Invested

Core Values: The Intersection of Wealth and Wellness

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

What Noel and Liam Gallagher Can Teach Us About Estate Planning

The Gallagher brothers’ reunion reminds us that family conflicts can be mended—but in estate planning, clear communication, thoughtful succession, and professional guidance are key to preserving relationships and legacy.

The Role of Emotions and Behavior in Your Financial Journey

When it comes to managing your finances, it’s easy to focus solely on numbers—budgeting, investments, retirement goals. But what often gets overlooked is the emotional and behavioral side of money.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Leading the Family Business: Legacy, Emotions, and Growth

Family businesses are unique because they carry both the weight of history and the promise of the future.

What is Wealth?

According to Investopedia “wealth is measured by taking the value of all the assets of worth owned by a person. This is determined by taking the total market value of all physical and intangible assets owned, then subtracting all debts. Essentially, wealth is the accumulation of scarce resources.”

How Many Summers?

After my first son was born, I began to think about what the next phase of our lives looked like. We went from two busy professionals who could hop on a plane for a weekend trip, grab dinner, or chase endless weekend adventures to first time parents. We were 2,000 miles away from family trying to plan the one or two trips a year that we could see them which led me to ask this question, how many summers do we have left?

The Power of Time

Our humans are brains are instinctively wired to prioritize immediate needs and wants, such as quenching hunger, ensuring safety, or yielding to the allure of instant gratification. This is a survival mechanism that has evolved over tens of thousands of years to help us respond to threats, opportunities, and ultimate survival. However, this tendency to emphasize the short term can be counterproductive and have a detrimental effect when it comes to planning and our financial success.

Last One Out

“Hey, do you want to grab onto the kayak?” These words echoed in my ears as I struggled through the swim portion of my first Olympic distance triathlon. There I was floundering in the water, struggling to breathe, and flopping between a bad backstroke and freestyle. I lifted my head and painfully realized I was the last one in the lake.

Embracing the Spectrum of Emotions

Investing can be an emotional roller coaster, with the excitement of portfolio growth followed by the panic of market downturns. This emotional ride is rooted in the experience of loss aversion, a psychological principle suggesting the pain felt from financial loss is twice as potent as the pleasure experienced from a similar gain. However, it's crucial to recognize that allowing our emotions to guide our investment decisions can lead to irrational choices.

Charting the Course

Our humans are brains are instinctively wired to prioritize immediate needs and wants, such as quenching hunger, ensuring safety, or yielding to the allure of instant gratification. This is a survival mechanism that has evolved over tens of thousands of years to help us respond to threats, opportunities, and ultimate survival. However, this tendency to emphasize the short term can be counterproductive and have a detrimental effect when it comes to planning and our financial success.

Small Steps, Giant Leaps: A Journey of 22 Years

Our humans are brains are instinctively wired to prioritize immediate needs and wants, such as quenching hunger, ensuring safety, or yielding to the allure of instant gratification. This is a survival mechanism that has evolved over tens of thousands of years to help us respond to threats, opportunities, and ultimate survival. However, this tendency to emphasize the short term can be counterproductive and have a detrimental effect when it comes to planning and our financial success.

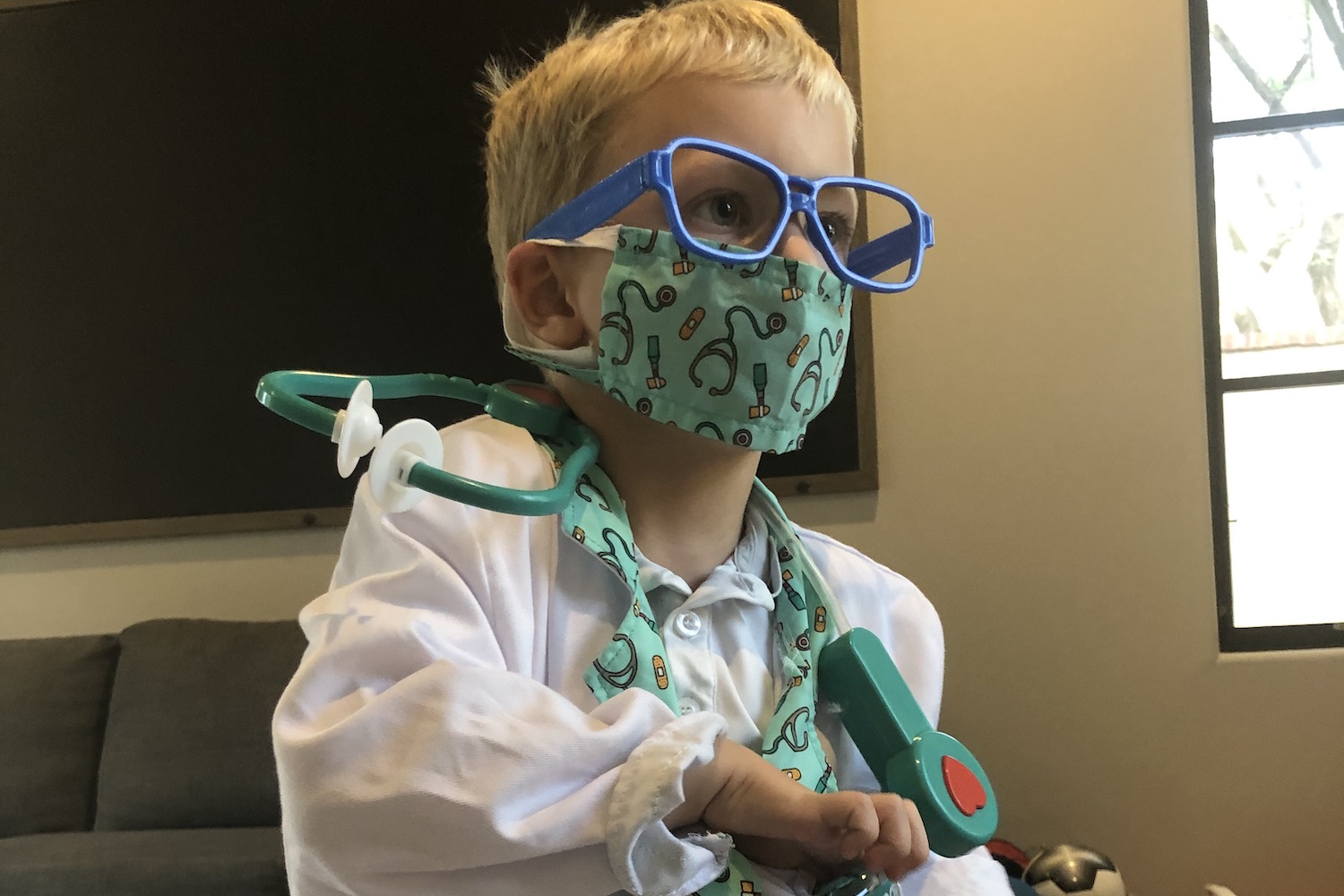

The Intersection of Health and Wealth

A recent study conducted by Fidelity found that healthcare and medical expenses for a 65-year-old retiring in 2021 are expected to surpass $300,000 throughout retirement. This represents a 30% increase from a decade ago and a staggering 88% rise from twenty years ago.

Lessons from 234,000 Steps

Our humans are brains are instinctively wired to prioritize immediate needs and wants, such as quenching hunger, ensuring safety, or yielding to the allure of instant gratification. This is a survival mechanism that has evolved over tens of thousands of years to help us respond to threats, opportunities, and ultimate survival. However, this tendency to emphasize the short term can be counterproductive and have a detrimental effect when it comes to planning and our financial success.

Be Like Lebron

Our humans are brains are instinctively wired to prioritize immediate needs and wants, such as quenching hunger, ensuring safety, or yielding to the allure of instant gratification. This is a survival mechanism that has evolved over tens of thousands of years to help us respond to threats, opportunities, and ultimate survival. However, this tendency to emphasize the short term can be counterproductive and have a detrimental effect when it comes to planning and our financial success.

Hanging with 20,000 of my Closest Friends

Our humans are brains are instinctively wired to prioritize immediate needs and wants, such as quenching hunger, ensuring safety, or yielding to the allure of instant gratification. This is a survival mechanism that has evolved over tens of thousands of years to help us respond to threats, opportunities, and ultimate survival. However, this tendency to emphasize the short term can be counterproductive and have a detrimental effect when it comes to planning and our financial success.

The Talk You Shouldn't Skip with Your Kids

Our humans are brains are instinctively wired to prioritize immediate needs and wants, such as quenching hunger, ensuring safety, or yielding to the allure of instant gratification. This is a survival mechanism that has evolved over tens of thousands of years to help us respond to threats, opportunities, and ultimate survival. However, this tendency to emphasize the short term can be counterproductive and have a detrimental effect when it comes to planning and our financial success.

It's Just 7,905 Miles to My Closest Friends

Our humans are brains are instinctively wired to prioritize immediate needs and wants, such as quenching hunger, ensuring safety, or yielding to the allure of instant gratification. This is a survival mechanism that has evolved over tens of thousands of years to help us respond to threats, opportunities, and ultimate survival. However, this tendency to emphasize the short term can be counterproductive and have a detrimental effect when it comes to planning and our financial success.

When Silence Costs a Fortune

Our humans are brains are instinctively wired to prioritize immediate needs and wants, such as quenching hunger, ensuring safety, or yielding to the allure of instant gratification. This is a survival mechanism that has evolved over tens of thousands of years to help us respond to threats, opportunities, and ultimate survival. However, this tendency to emphasize the short term can be counterproductive and have a detrimental effect when it comes to planning and our financial success.

The Experience Mickey Built

Our humans are brains are instinctively wired to prioritize immediate needs and wants, such as quenching hunger, ensuring safety, or yielding to the allure of instant gratification. This is a survival mechanism that has evolved over tens of thousands of years to help us respond to threats, opportunities, and ultimate survival. However, this tendency to emphasize the short term can be counterproductive and have a detrimental effect when it comes to planning and our financial success.

Enjoy the Ride (...and the Fries)

Investing can be an emotional roller coaster, with the excitement of portfolio growth followed by the panic of market downturns. This emotional ride is rooted in the experience of loss aversion, a psychological principle suggesting the pain felt from financial loss is twice as potent as the pleasure experienced from a similar gain. However, it's crucial to recognize that allowing our emotions to guide our investment decisions can lead to irrational choices.